Last Updated on January 31, 2026 by Dogs Vets

As a dog owner, your furry best friend likely rides shotgun for park trips, vet visits, road adventures, or daily errands. But what happens if you’re in a car accident? Does your auto insurance cover your dog’s vet bills if they’re injured?

The short answer: Standard car insurance treats pets like property, so coverage for your dog’s injuries is limited or nonexistent unless you have a specific pet injury endorsement (also called pet medical coverage). This add-on typically pays $500–$1,000 (sometimes more) toward vet bills, burial costs, or related expenses from a covered collision, fire, or theft.

In 2026, few major insurers offer robust pet injury coverage—most provide little to none automatically. Dedicated pet health insurance (e.g., from ASPCA, Spot, or Pets Best) often provides far better protection for accident-related vet bills, with higher limits ($5,000–unlimited) and no-fault coverage.

This guide ranks the best car insurance options for dog owners in 2026, focusing on pet-friendly features, affordability, and safety tips. Data draws from recent reviews (NerdWallet, U.S. News, Forbes, Insurance Information Institute, and insurer sites as of early 2026).

Why Dog Owners Need Special Car Insurance Considerations

Car accidents pose serious risks to pets: ejection from open windows, airbag injuries, or trauma from crashes. Pets are legally “personal property,” so:

- If your dog is injured while riding with you: Collision/comprehensive may cover vehicle damage, but pet vet bills require a pet injury add-on (rare, low limits).

- If you hit someone else’s dog: Comprehensive covers your car damage (deductible applies); liability may cover the other dog’s vet bills if you’re at fault.

- If another driver hits your dog: Their liability/property damage could cover vet costs.

Pet injury add-ons are not widespread—availability varies by state and policy. Always check your declarations page and disclose your dog honestly.

Infographic: Car Accident Risks for Dogs

(Visual showing common dangers like loose pets causing distractions, ejection risks, and recommended restraints.)

This infographic highlights why crash-tested harnesses and crates are essential.

Top Car Insurance Companies for Dog Owners in 2026

Here are the standout options based on pet coverage availability, overall ratings, discounts, and dog-owner feedback.

- Progressive — Best Overall for Pet Injury Coverage

Progressive leads with automatic pet injury coverage up to $1,000 in many states (included with collision/comprehensive—no extra cost in eligible policies). Covers vet bills for cats/dogs injured in accidents. Strong for bundling, Snapshot telematics discounts, and rideshare coverage. High J.D. Power loyalty scores; competitive rates. - Chubb / High-Net-Worth Carriers — Best for Higher Limits

Chubb (and similar premium insurers) often offers expanded pet medical riders ($2,000+ possible) for luxury vehicles or high-value policies. Excellent for comprehensive protection, but premiums are higher. - Elephant Insurance — Solid Automatic Coverage

Up to $1,000 pet injury included with collision in select states—great for budget-conscious dog owners. - State Farm, Geico, Allstate — Limited but Reliable Overall

These giants rarely include pet injury automatically (often $0 unless rare add-on). State Farm and Geico excel in affordability, multi-policy discounts (bundle with home/pet insurance), and widespread agents. Geico offers strong discounts; State Farm has top claims satisfaction.

Comparison Table: Pet-Friendly Car Insurance (2026 Estimates)

| Company | Pet Injury Coverage | Typical Limit | Avg. Full Coverage Premium Est. | Key Pros for Dog Owners | Drawbacks |

|---|---|---|---|---|---|

| Progressive | Automatic in many states | Up to $1,000 | $1,900–$2,800 | Built-in pet add-on, telematics savings, rideshare | Rates higher in some areas |

| Chubb | Optional rider (higher) | $2,000+ | Higher ($3,000+) | Premium limits, high-value vehicle focus | Expensive for average drivers |

| Elephant | Automatic with collision | Up to $1,000 | Competitive | Easy add-on inclusion | Limited availability by state |

| Geico | Rare add-on (minimal) | Low/$0 | $1,800–$2,500 | Cheap rates, bundle discounts | No standard pet coverage |

| State Farm | Rare add-on (minimal) | Low/$0 | $2,000–$2,700 | Excellent service, agents everywhere | Limited pet-specific features |

Rates vary by location, driving record, vehicle, and dog factors—get personalized quotes.

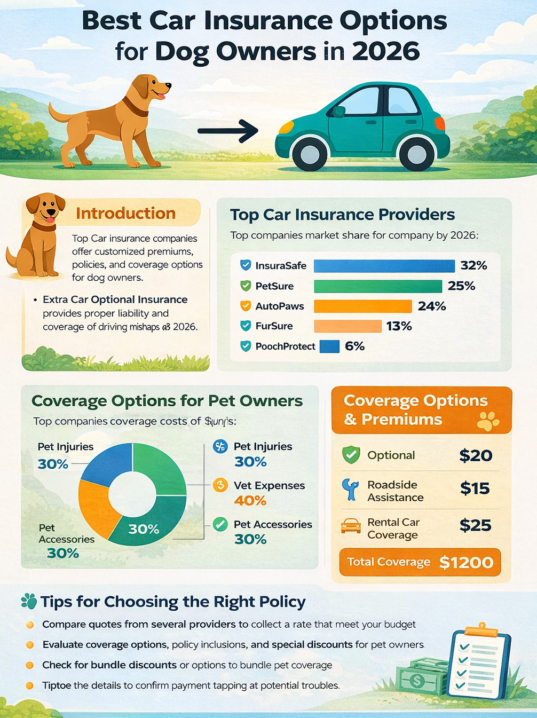

Infographic: Pet Injury Coverage Comparison

(Bar chart showing limits across top insurers: Progressive $1,000, Chubb higher, others low.)

This visual breaks down typical pet medical payouts in auto policies.

Why Dedicated Pet Insurance Often Beats Car Add-Ons

Auto pet coverage caps low ($1,000 max common), while pet health insurance covers accidents (including car crashes) with:

- Higher limits ($5k–unlimited)

- No-fault (covers regardless of who caused the crash)

- Broader benefits (illness, wellness add-ons)

Top 2026 pet insurers for dog owners: ASPCA (best overall), Spot (perks/quick claims), Pets Best (budget-friendly), Lemonade (fast AI claims, bundling).

Pair auto + pet insurance for full protection—many offer multi-policy discounts.

Essential Safety Tips for Traveling with Dogs

Prevent accidents and lower risks/claims:

- Use crash-tested harnesses or crates (Kurgo, Sleepypod—never loose or on laps).

- Avoid open windows (ejection risk).

- Secure heavy items to prevent shifting.

- Never leave dogs in hot cars.

- Train for calm rides; consider anxiety aids.

Link to your blog’s dog training or road trip posts!

Infographic: Safe Dog Car Travel Checklist

(Infographic with icons: harness, crate, no loose pets, ventilation, etc.)

A practical visual for dog parents.

FAQ: Top Questions from Dog Owners

Does car insurance cover my dog’s vet bills in an accident?

Limited—only if you have pet injury add-on (e.g., Progressive up to $1,000). Otherwise, rely on pet insurance.

What if I hit a dog with my car?

Comprehensive covers your vehicle damage; liability may cover the dog’s vet bills if at fault.

Will pet coverage raise my auto premiums?

Minimal impact—add-ons are cheap or included.

Is pet insurance better for car accidents?

Yes—higher limits, covers any cause (not just vehicle-related).

Can I bundle auto and pet insurance?

Yes—companies like Lemonade or Geico offer discounts.

Final Thoughts

For dog owners in 2026, Progressive stands out for built-in pet injury coverage—pair it with strong pet health insurance (ASPCA, Spot) for complete peace of mind. Review policies yearly, prioritize safe travel habits, and shop quotes.

Protect your pup—get a free car insurance quote today and explore pet plans. Safe travels and happy tail wags!