Last Updated on March 24, 2023 by Dogs Vets

Pet Insurance for Large Breed Dogs: A Complete Guide

As pet owners, we all want our furry friends to be happy and healthy. However, accidents and illnesses can happen, and veterinary bills can quickly add up. This is where pet insurance comes in.

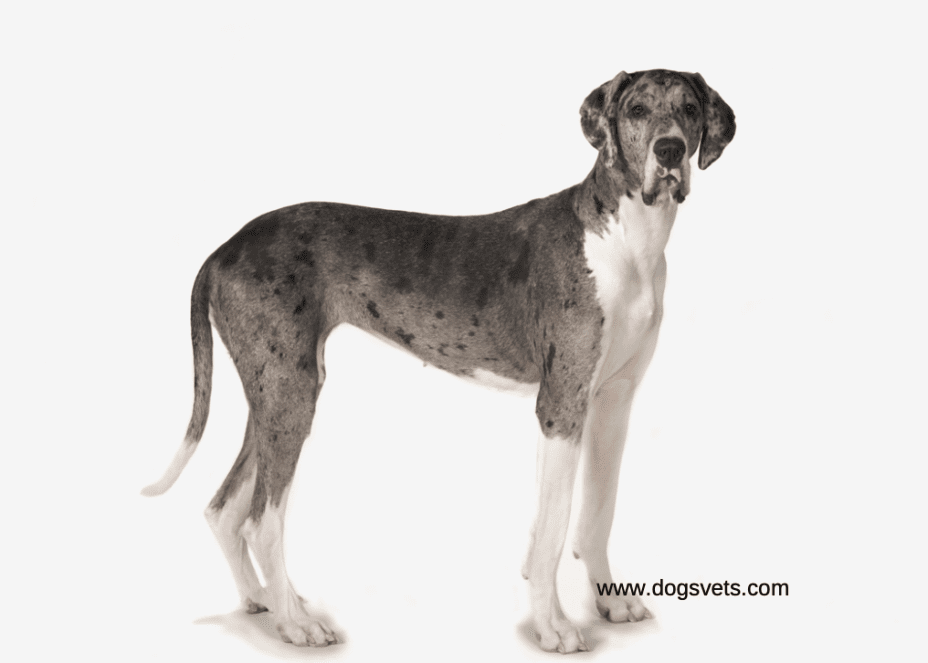

Large breed dogs are popular for their loyalty, strength, and loving personalities. However, they also face unique health challenges and may require specialized care.

Pet insurance for large breed dogs is essential to ensuring your furry friend has access to the care they need without causing undue financial strain.

In this article, we will discuss the importance of pet insurance for large breed dogs, how it works, what to consider when choosing a plan, and some of the best pet insurance options available.

Why Pet Insurance is Important for Large Breed Dogs

Large breed dogs are more prone to certain health issues, such as hip dysplasia, arthritis, and bloat. These conditions can require expensive treatments, surgeries, and medications, which can quickly add up to thousands of dollars in veterinary bills.

Pet insurance can help cover the cost of unexpected medical expenses, ensuring that you can provide the best possible care for your furry friend without breaking the bank.

It can also provide peace of mind, knowing that you are financially prepared for any unexpected health issues that may arise.

How Pet Insurance Works

Pet insurance works similarly to human health insurance. You pay a monthly or annual premium, and in return, the insurance company covers a portion of your pet’s medical expenses.

The exact coverage and reimbursement rates vary depending on the plan you choose.

When your pet needs medical treatment, you will pay the veterinarian upfront and then submit a claim to the insurance company for reimbursement.

Some insurance companies offer direct payment to the veterinarian, but this varies depending on the plan.

What to Consider When Choosing a Pet Insurance Plan

When choosing a pet insurance plan, there are several factors to consider:

- Coverage: Make sure the plan covers the conditions and treatments your pet may need. Some plans may exclude pre-existing conditions or certain breeds.

- Cost: Consider the monthly or annual premium, deductibles, and reimbursement rates. Make sure the plan fits your budget and provides adequate coverage.

- Customer Service: Look for a company with good customer service and easy claims processing. Read reviews and ask for recommendations from other pet owners.

- Extras: Some plans may offer additional benefits, such as wellness care or coverage for alternative therapies. Consider whether these extras are important to you.

Top Pet Insurance Options for Large Breed Dogs

There are many pet insurance options available, but here are some of the best options for large breed dogs:

- Healthy Paws – Healthy Paws is a popular choice for pet insurance, offering comprehensive coverage with no lifetime or annual limits. They also have a fast claims process and excellent customer service.

- Embrace – Embrace offers customizable plans with a range of deductibles and reimbursement rates. They also offer coverage for alternative therapies, such as acupuncture and chiropractic care.

- Trupanion – Trupanion offers one simple plan with no payout limits, making it easy to understand and use. They also offer direct payment to the veterinarian in some cases.

- Nationwide – Nationwide offers a range of plans, including a wellness plan that covers routine care, such as vaccinations and check-ups. They also offer coverage for hereditary and congenital conditions.

Conclusion

Pet insurance can provide peace of mind and financial security for large breed dog owners. When choosing a plan, consider the coverage, cost, customer service, and extras offered.

Some of the top pet insurance options for large breed dogs include Healthy Paws, Embrace, Trupanion, and Nationwide.

By investing in pet insurance, you can ensure that you can provide the best possible care for your furry friend without breaking the bank.

FAQs

What is the best pet insurance for large dog breed?

There is no one-size-fits-all answer to this question, as the best pet insurance plan for your large breed dog will depend on your specific needs and budget. However, some of the top options include Healthy Paws, Embrace, Trupanion, and Nationwide.

What does pet insurance cover?

Pet insurance can cover a range of medical expenses, including accidents, illnesses, and chronic conditions. Some plans may also cover routine care, such as vaccinations and check-ups.

Are pre-existing conditions covered by pet insurance?

Most pet insurance plans exclude pre-existing conditions from coverage. It is important to read the policy carefully and understand any exclusions before purchasing a plan.

How much does pet insurance cost?

The cost of pet insurance varies depending on several factors, including the coverage amount, deductible, and reimbursement rate. Generally, you can expect to pay anywhere from $20 to $60 per month for pet insurance.

When should I purchase pet insurance for my large breed dog?

It is best to purchase pet insurance when your dog is young and healthy, before any pre-existing conditions arise. This ensures that you can get the best coverage possible and avoid any exclusions for pre-existing conditions.

What is a deductible?

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and your dog’s medical bill is $2,000, you will pay $500 and the insurance company will cover the remaining $1,500.

Can I use any veterinarian with pet insurance?

Most pet insurance plans allow you to use any licensed veterinarian. However, some plans may have a network of preferred providers or may require pre-approval for certain treatments.

It is important to read the policy carefully and understand any restrictions before purchasing a plan.

Finally, pet insurance can be a valuable investment for large breed dog owners, helping to provide financial security and peace of mind in the event of unexpected medical expenses.

When choosing a plan, consider the coverage, cost, customer service, and extras offered, and be sure to read the policy carefully to understand any exclusions or restrictions.

With the right pet insurance plan, you can provide the best possible care for your furry friend without breaking the bank.

Fact Check

We hope you enjoyed reading this article. What are your thoughts on the topic?

“At [Dogsvets.com], our goal is to bring you the most accurate and up-to-date information on all things pet-related.

If you have any additional insights or would like to advertise with us, don’t hesitate to get in touch.

If you notice any errors or discrepancies in our content, please let us know so we can correct them.

We welcome your feedback and encourage you to share this article with others.”