Last Updated on January 31, 2026 by Dogs Vets

As a dog lover, your furry companion is part of the family—whether it’s a playful Labrador joining you on car rides or a protective German Shepherd guarding the home. But with dog ownership comes real risks: dog bites and pet injuries in accidents can lead to massive vet bills or liability claims.

In 2024 (latest comprehensive data available as of early 2026), U.S. insurers paid out $1.57 billion in dog-related injury claims, covering 22,658 incidents—an 18.9% increase from 2023. The average claim cost hit $69,272, up 18.3% year-over-year, driven by rising medical expenses, legal fees, and settlements. Over the past decade, costs have surged dramatically, making proper coverage essential for responsible dog parents.

Homeowners insurance typically covers dog bite liability through personal liability protection (often $100,000–$500,000+), paying for medical bills, lawsuits, and damages if your dog injures someone on your property. Car insurance, however, treats pets as “property,” offering limited or no coverage for vet bills if your dog is hurt in a crash—unless you add specific pet injury riders.

This 2026 guide ranks the most dog-friendly homeowners and auto insurance companies, based on breed policies, pet coverage options, customer reviews, and affordability from sources like Insurify, Policygenius, MoneyGeek, Insuranceopedia, and the Insurance Information Institute (III)/State Farm reports.

Why Dog Owners Need Specialized Insurance Considerations

Many insurers impose breed restrictions on “high-risk” breeds like Pit Bulls, Rottweilers, German Shepherds, Dobermans, Akitas, Chow Chows, and Mastiffs due to perceived bite risks. Others evaluate on individual behavior, bite history, or require Canine Good Citizen certification. For car coverage, pet injury add-ons are rare and low-limit ($500–$2,000 typical), so dedicated pet insurance often fills gaps better for vet costs.

Always disclose your dog’s details honestly—misrepresentation can void claims. Shop multiple quotes, as rates and policies vary by state, home value, and dog specifics.

Infographic: National Dog Bite Liability Statistics (2023-2024 Trends)

These visuals from the Insurance Information Institute highlight the rising costs and number of claims—perfect context for why dog-friendly coverage matters.

Top Dog-Friendly Homeowners Insurance Companies in 2026

These companies stand out for flexible or no breed exclusions, strong liability coverage, and positive feedback from dog owners.

- State Farm — Often ranked #1 overall for dog owners. State Farm evaluates dogs individually based on behavior and history, not breed. They don’t ask for breed when writing policies and cover many “restricted” breeds if no prior incidents. Excellent financial strength (A++ AM Best), widespread agents, and competitive rates. Ideal for Pit Bull or Rottweiler owners with well-behaved dogs.

- Allstate — Strong individualized underwriting. Case-by-case reviews focus on your dog’s temperament over breed. They provide pet safety resources and often cover breeds others exclude. High customer satisfaction in many areas and solid claims handling.

- USAA (Military/veterans and families only) — Breed-neutral and top-rated. No breed restrictions in most cases, with superior service, low complaints, and competitive premiums for eligible members. Frequently praised for dog-friendly policies.

- Nationwide — Flexible and inclusive. Considers behavior over breed, good for multi-pet homes, and offers multi-policy discounts. Reliable for various breeds without automatic blacklists.

- Chubb, Amica, Liberty Mutual, Plymouth Rock — Premium or flexible options. Chubb excels for high-value homes with generous liability limits and pet accommodations. Amica offers top customer service and flexibility. Liberty Mutual and Plymouth Rock often insure otherwise restricted breeds on a case-by-case basis.

Comparison Table: Dog-Friendly Homeowners Insurers (2026 Estimates)

| Company | Breed Restrictions | Typical Liability Limit | Avg. Annual Premium Est. | Key Pros | Potential Drawbacks |

|---|---|---|---|---|---|

| State Farm | None automatic (behavior-based) | $100k–$500k+ | $1,200–$2,200 | Affordable, no breed questions, widespread availability | May require dog history review |

| Allstate | Case-by-case | Similar | $1,300–$2,400 | Pet safety guides, flexible | Varies significantly by state |

| USAA | Breed-neutral | High | Lower for eligible | Excellent service, low complaints | Eligibility restricted to military |

| Nationwide | Flexible/behavior-focused | $300k common | Competitive | Multi-pet discounts | Mixed claims reviews in some areas |

| Chubb | Flexible (high-net-worth) | $500k–$1M+ | Higher ($2,500+) | Premium coverage, high limits | More expensive for average homes |

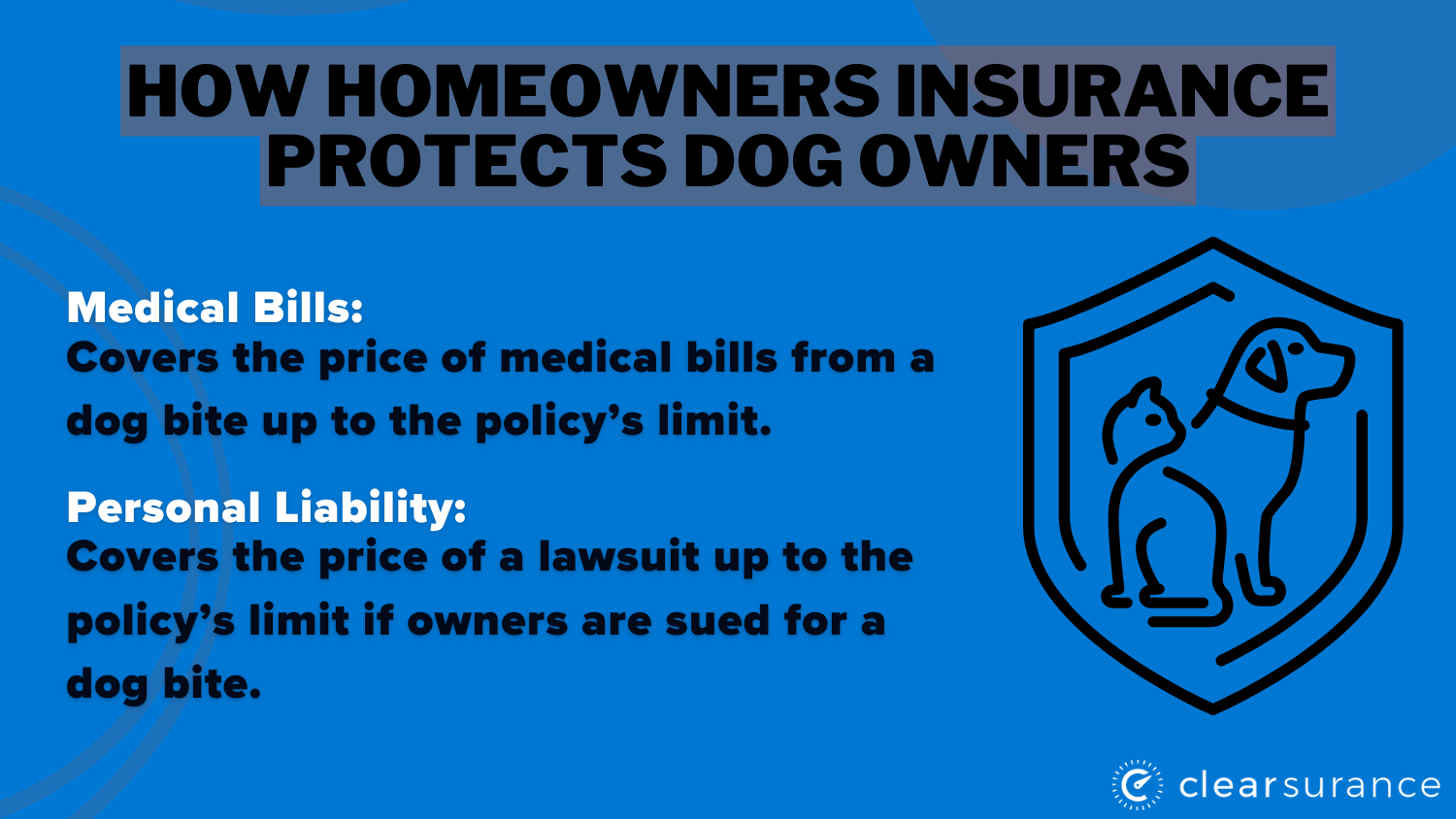

Infographic: How Homeowners Insurance Protects Dog Owners

Do I have to add my dog to my homeowners insurance? (+Why it …

This clear visual breaks down liability and medical payments coverage for dog bite scenarios.

For restricted breeds, consider an umbrella policy ($1M+ extra liability, often $150–$300/year) for added protection.

Best Car Insurance Options for Dog Owners in 2026

Standard auto policies rarely cover pet vet bills fully—your dog is considered “property.” If injured in a crash while riding with you, coverage is minimal unless you add pet injury protection. Hitting an animal typically falls under comprehensive (covers vehicle damage, deductible applies).

Notable options with pet-friendly features:

- Progressive — Often includes pet injury coverage up to $1,000 with collision in many states (check your policy). Popular among dog owners for affordability and add-ons.

- Chubb / High-end carriers — Higher pet medical limits possible (e.g., $2,000+ riders) for luxury or comprehensive policies.

- Elephant Insurance — Up to $1,000 automatic with collision in select areas.

Major carriers like Geico, State Farm, and Allstate usually offer little to no pet injury unless a rare rider. Comprehensive covers your car if you swerve to avoid or hit a dog.

Strong Recommendation: Pair auto with dedicated pet insurance (e.g., ASPCA, Spot, Pumpkin, Pets Best, Embrace) for broader accident/illness coverage—no fault required, higher limits ($5,000–$10,000+ annual). These handle vet bills from car crashes, bites, or illnesses regardless of homeowners/auto involvement.

Prevention Tips: Lower Risks and Protect Your Pup (Dog Blog Essentials)

Responsible ownership reduces claims and premiums:

- Socialize and train early — Obedience classes or Canine Good Citizen certification impresses insurers.

- Spay/neuter — Often lowers aggression risks.

- Secure your yard — Tall fencing prevents escapes.

- Supervise interactions — Especially with kids or guests.

- Car safety — Use crash-tested harnesses or crates (brands like Kurgo or Sleepypod). Never let dogs ride loose or on laps—ejection risks are high.

- Leash laws & bite prevention — Follow local rules; educate on reading dog body language.

Link these to your other blog posts on training, breed guides, or road trips with dogs!

Infographic: Safe Car Travel with Dogs – Key Risks & Checklist

Road Safety Risks from Pets in and Around Vehicles

This detailed guide illustrates projectile risks, airbag dangers, heat hazards, and essential safety tools like harnesses and crates.

FAQ: Common Questions from Dog Owners

Does homeowners insurance cover dog bites off your property? Usually limited or no—coverage often applies only on your premises. Umbrella policies help extend protection.

Will a dog bite claim raise my premiums? Likely yes, and it may lead to non-renewal. Shop new carriers afterward.

What if my dog is a restricted breed? Start with State Farm, Allstate, or USAA. Disclose everything; consider umbrella coverage.

Does car insurance cover if my dog causes an accident? Liability may cover third-party damages (e.g., if your dog distracts you), but pet injury is limited.

Is dedicated pet insurance worth it over home/auto add-ons? Yes—for comprehensive vet bill protection from any cause.

5 Most Searched Questions & Answers for Dog Owners

1. Does homeowners insurance cover dog bites? Yes, in most cases—standard policies include personal liability coverage that pays for medical bills, legal fees, lost wages, and damages if your dog bites someone and you’re found liable. Medical payments coverage (no-fault, smaller amounts) often helps with guest injuries on your property. However, it depends on your policy: exclusions for certain breeds (e.g., Pit Bulls, Rottweilers), prior bite history, or off-property incidents can apply. Always review your policy and disclose your dog’s breed/behavior honestly—coverage isn’t automatic everywhere.

2. Which dog breeds are excluded from homeowners insurance? Many insurers restrict or exclude “high-risk” breeds like Pit Bulls, Rottweilers, German Shepherds, Dobermans, Akitas, Chow Chows, Mastiffs, and similar due to higher claim risks. Some companies (e.g., State Farm, Allstate) use case-by-case evaluations based on behavior rather than breed bans. Others may require extra liability or deny coverage outright. Shop dog-friendly providers and consider an umbrella policy for extra protection if you own a restricted breed.

3. Does homeowners insurance cover dog bites if my dog has bitten before? Often no—prior bite history almost always triggers exclusions, non-renewal, or higher premiums. Insurers view aggressive history as a major risk. Report incidents promptly if required by your policy, but expect potential changes. Switching to a more flexible carrier (like those listed above) or adding umbrella coverage can help, but full disclosure is crucial to avoid claim denials.

4. Does car insurance cover my dog’s vet bills if injured in an accident? Limited—standard policies treat pets as “property,” so coverage for your dog’s injuries (while riding with you) is usually minimal or none without a pet injury add-on. Progressive often includes up to $1,000 (sometimes automatic with collision), and some high-end carriers offer higher limits. If you hit someone else’s dog, comprehensive may cover your vehicle damage, and liability could address their vet bills if you’re at fault. For better protection, rely on dedicated pet insurance.

5. Will my homeowners insurance premiums increase after a dog bite claim? Yes, in most cases—claims (especially large ones) often lead to rate hikes at renewal, or even non-renewal/cancellation. Some insurers drop high-risk dogs entirely. Minor incidents might have less impact if no payout occurs, but always check your policy’s reporting requirements. After a claim, shop around for new quotes from dog-friendly companies to potentially lower costs.