Last Updated on January 10, 2024 by Dog Lover

Pet Insurance Cost in Alabama: What You Need to Know Before You Enroll

Alabama, with its rolling hills, historic charm, and vibrant cities, is a great place to call home.

But for residents with furry companions, the question of pet insurance cost in Alabama is bound to pop up sooner or later.

After all, who wants to face a hefty vet bill just as the weekend barbecue heats up?

Here’s the good news: Alabama pet insurance can be a lifesaver, providing financial peace of mind and ensuring your beloved pup or kitty receives the best possible care, no matter what life throws your way.

But before you jump tail-first into a policy, let’s navigate the maze of cost considerations and find the perfect fit for your four-legged friend and your wallet.

Fur-ocious Factors: What Impacts Your Pet Insurance Premium?

Think of your pet insurance premium as a personalized recipe, a unique blend of ingredients influencing the final price.

Here are the main chefs in the kitchen:

- Species & Breed: Fluffy felines are generally cheaper to insure than boisterous bulldogs. Breed-specific health risks also play a role, with Golden Retrievers facing higher premiums than, say, a sprightly Schnauzer.

- Age: A sprightly puppy or frisky kitten will cost less to insure than a senior pooch with a few more miles on the paws.

- Location: While Alabama tends to offer slightly lower vet costs than the national average, your zip code can still impact your premium. Urban areas typically see higher prices than rural locations.

- Coverage Plan: This is where you get to choose your toppings! Accident-only plans are like a light sprinkling of parmesan, while comprehensive plans are a full-blown feast of accident, illness, and wellness coverage.

- Deductible & Reimbursement: Think of these as your co-pay at the vet. A higher deductible lowers your monthly premium, but you’ll pay more out-of-pocket before the insurance kicks in. Reimbursement percentage determines how much of the covered amount the insurance company pays back – 80% is common, but higher options are available.

Alabama vs. the Nation: Pawsitive Pricing Trends

Now, let’s address the elephant in the room – how does Alabama stack up against the national average?

The good news is, pet insurance in Alabama tends to be slightly cheaper than the national average (whew!).

This is partly due to lower vet costs in the state compared to, say, bustling coastal cities.

Here’s a ballpark estimate:

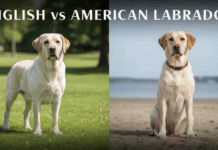

- Dog insurance: A 6-month-old Lab in Alabama might cost around $35-$45 per month with a $5,000 annual coverage limit, while the national average could be closer to $45-$55.

- Cat insurance: A playful 3-year-old Maine Coon in Alabama could be covered for $20-$25 per month with a $5,000 annual limit, compared to the national average of $23-$29.

Of course, these are just rough estimates, and your actual quote will depend on the factors mentioned above.

Unleashing Affordable Options: Finding the Right Policy for Your Pocket

Now that you’ve got the lowdown on cost factors, let’s sniff out some ways to trim the cost without sacrificing quality coverage:

- Shop around: Get quotes from multiple pet insurance companies. Online comparison tools can save you time and effort.

- Choose a higher deductible: If you can handle a larger upfront cost, a higher deductible will lower your monthly premium.

- Opt for preventative care coverage: While some basic plans exclude this, adding a wellness rider can save you money on routine check-ups and vaccinations in the long run.

- Consider breed-specific discounts: Some companies offer discounts for certain breeds.

- Bundle your policies: If you have multiple pets, some companies offer bundle discounts.

Remember, the cheapest policy isn’t always the best.

Be sure to compare coverage details and read reviews before making a decision.

After all, the last thing you want is to be left without adequate coverage when your furry friend needs it most.

Beyond the Bottom Line: More Than Just Numbers

While cost is definitely an important consideration, remember that pet insurance is an investment in your furry family member’s health and well-being.

Think of it as a safety net that allows you to focus on what truly matters – providing your four-legged friend with a happy and healthy life.

With the right coverage, you can breathe easy knowing that unexpected illnesses or accidents won’t derail your budget or force you to make tough decisions about your pet’s care.

So, is pet insurance worth it in Alabama? That’s a question only you can answer.

But if you value peace of mind, financial security, and ensuring your precious pup or purring pal receives the best possible care, regardless of what life throws your way, then pet insurance might just be the paw-fect decision.

Finding Your Furever Policy: A Step-by-Step Guide

Now that you’re armed with the knowledge of pet insurance in Alabama, let’s walk you through the process of finding the perfect policy for your furry friend:

1. Determine your needs and budget: Ask yourself what kind of coverage you want (accident-only, comprehensive, etc.) and how much you’re comfortable spending per month.

2. Research pet insurance companies: Look for reputable companies with good customer reviews and a strong track record. Check if they offer breed-specific discounts or other perks.

3. Get quotes: Use online comparison tools or contact companies directly to get personalized quotes. Be sure to provide accurate information about your pet’s breed, age, and location.

4. Read the fine print: Carefully review the policy details, including coverage exclusions, deductibles, reimbursement percentages, and renewal terms.

5. Ask questions: Don’t hesitate to contact the pet insurance company if you have any questions or concerns.

Remember, finding the right pet insurance is all about understanding your needs and making an informed decision.

Don’t be afraid to negotiate your premium or ask for additional discounts. After all, you’re the one paying the bills, and your furry friend deserves the best!

Frequently Asked Questions

Is pet insurance mandatory in Alabama?

No, pet insurance is not mandatory in Alabama. However, it can be a valuable investment to protect your pet’s health and your finances.

Are there any pet insurance companies that specialize in Alabama?

While there aren’t any companies specific to Alabama, many national pet insurance providers offer coverage in the state.

Can I cover my pet for pre-existing conditions?

In most cases, pet insurance will not cover pre-existing conditions. However, some companies offer plans that cover curable conditions after a waiting period.

Can I use my pet insurance at any vet in Alabama?

Many pet insurance companies allow you to use any licensed veterinarian in their network. However, it’s always best to check with your specific plan.

How do I file a claim with my pet insurance company?

Each company has its own claims process. Typically, you’ll need to submit a claim form and your vet bill. The company will then review your claim and issue a payment.

Pet insurance can be a powerful tool for pet owners in Alabama, providing financial security and peace of mind when unexpected health issues arise.

By understanding your needs, researching your options, and asking questions, you can find the perfect policy to protect your furry friend and ensure they receive the best possible care, no matter what life throws your way.

So go forth, explore, and remember, a happy and healthy pet is the greatest reward of all!

Verified Sources: